IRAS compliant EasyPay is complies with IRAS technical file format specifications to ensure that the format of the files records generated from the payroll software can be accepted by IRAS. The company goes forward to sell its undertaking and this is one of the widely used ways of business acquisition in India.

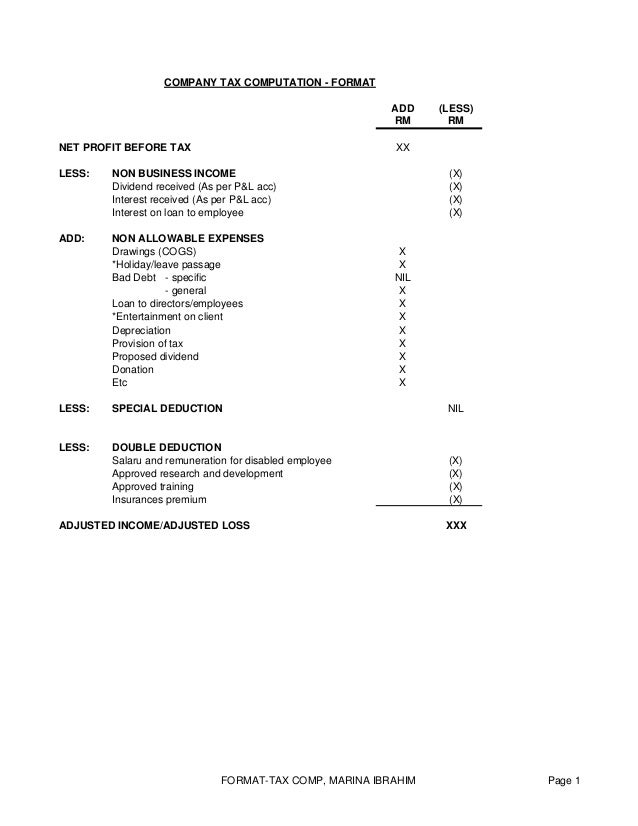

Company Tax Computation Format

This determination of the sale price may be referred to as the transfer price.

. Slump sale is generally undertaken. Salaries of the employees of both private and public sector organizations are composed of a number of. Sukanya Samriddhi Yojana Calculator.

You can edit the format of the company name and directors names if you dont want to use the Companies House format. Click the preview icon to view the accounts tax return or tax computation summary in document format. While the former defined slump sale the later provided the mode of computation of tax on slump sale.

Under this scheme a girls guardian can open a savings account in her name with an authorized Indian post office branch or a commercial bank. HRA or House Rent allowance also provides for tax exemptions. Controlled company - interpreted under Section 2 Income Tax Act 1967 ITA 1967 as a company having not more than fifty members and controlled by not more than five persons in the manner described by Section 139 ITA 1967.

Check company information and statutory filing deadlines. Sukanya Samriddhi Yojana SSY was launched in 2015 by the government of Indian as part of the Beti Bachao Beti Padhao Campaign. Acting on the recommendation to prevent erosion of Indias tax base the Income Tax Act 1961 was amended in April 2001 by substituting the existing section 92 and inserting sections 92A to 92F to introduce Indian transfer pricing regulations TPR in line with Article 9 of the Organization for Economic Co-operation and Development.

The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable. Compliant and up-to-date with local legislation in Singapore Malaysia Hong Kong Indonesia Thailand Philippines and Brunei. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

We would like to show you a description here but the site wont allow us. Inclusive of Personal e-Filing. Get 247 customer support help when you place a homework help service order with us.

Limiting the scope of the rule to covered payments between connected persons is in line with the policy and purpose of the STTR as articulated in section 91 above. The Innovations Group has been operating within the UAE for close to 2 decades and is one of the market leaders in Employee Outsourcing Recruitment services. A connected persons requirement ensures that the rule focuses on those cross-border tax planning arrangements that are designed to shift an amount from the source.

It makes a perfect savings scheme that parents can buy to give. Article 9 OECD Model Tax Convention On Income and On Capital - OECD defines related companies as. It will also be the basis of the output tax liability of the seller and the input tax claim of the buyer.

And section 50B to the Income Tax Act 1961. Now i would like to know how to fill-up the service invoice whenever we have. Allow multiple user to access and update a clients file concurrently.

The selling price of a product charged by the parent company to the subsidiary company may differ from the selling price with an independent third party. However such GST paid is also allowed as Input tax credit in same month and therefore net liability of tax will not increase. Tax Guru is a reliable source for latest Income Tax GST Company Law Related Information providing Solution to CA CS CMA Advocate MBA Taxpayers.

My business permit says im a retailer although my company name includes services. UNLIMITED clients and users. So if youre the super safe type of person just make sure that dividend is paid by from the company to your personal UK bank account rather than direct to your Thai bank account and dont bring those particular into Thailand for at least one year.

Xero Tax displays the company information stored at Companies House. Dividends are tax free as long as the money is only brought into thailand after 1 year. Excerpt from ASC 270-10-50-1j.

United Nations Office of Legal Affairs. Income Tax Assessment Year 2023-24. This document provides a copy of the Competent Authority Agreement entered into by the competent authorities of the United States and Canada regarding application of the principles set forth in the Organisation for Economic Cooperation and Development Report on the Attribution of Profits to Permanent Establishments in the interpretation of Article VII Business.

Article contains Automatic Income Tax Calculator in Excel Format for Financial Year 2022-23 FY 22-23 ie. Defined value DV DV value for real property means market value of the real property. Mobile TaxComp - Allow users to compute TaxCompe-filing at anytime and anywhere.

But there is a long drawn background. Example A trader who is registered in GST takes services of Goods Transport Agency GTA for Rs. Bir issued atp to us service invoice instead of sales invoice.

This service is listed under the reverse charge list therefore trader has to pay tax 18 on Rs. The amount of net periodic benefit cost recognized for each period for which a statement of income is presented showing separately the service cost component the interest cost component the expected return on plan assets for the period the gain or loss component the prior service cost or credit component the transition.

Company Tax Computation Format

Tax Computation Malaysia Fill Online Printable Fillable Blank Pdffiller

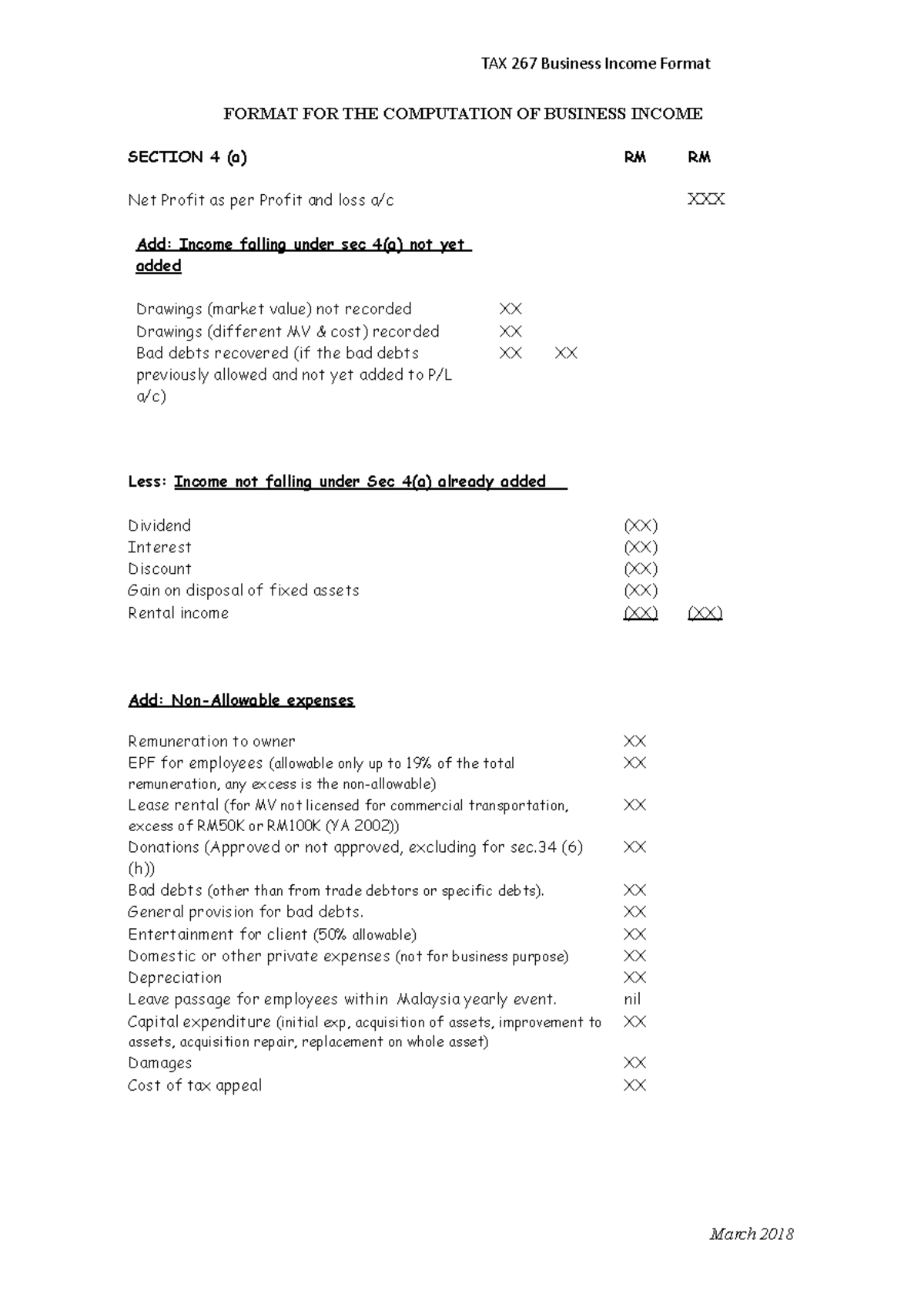

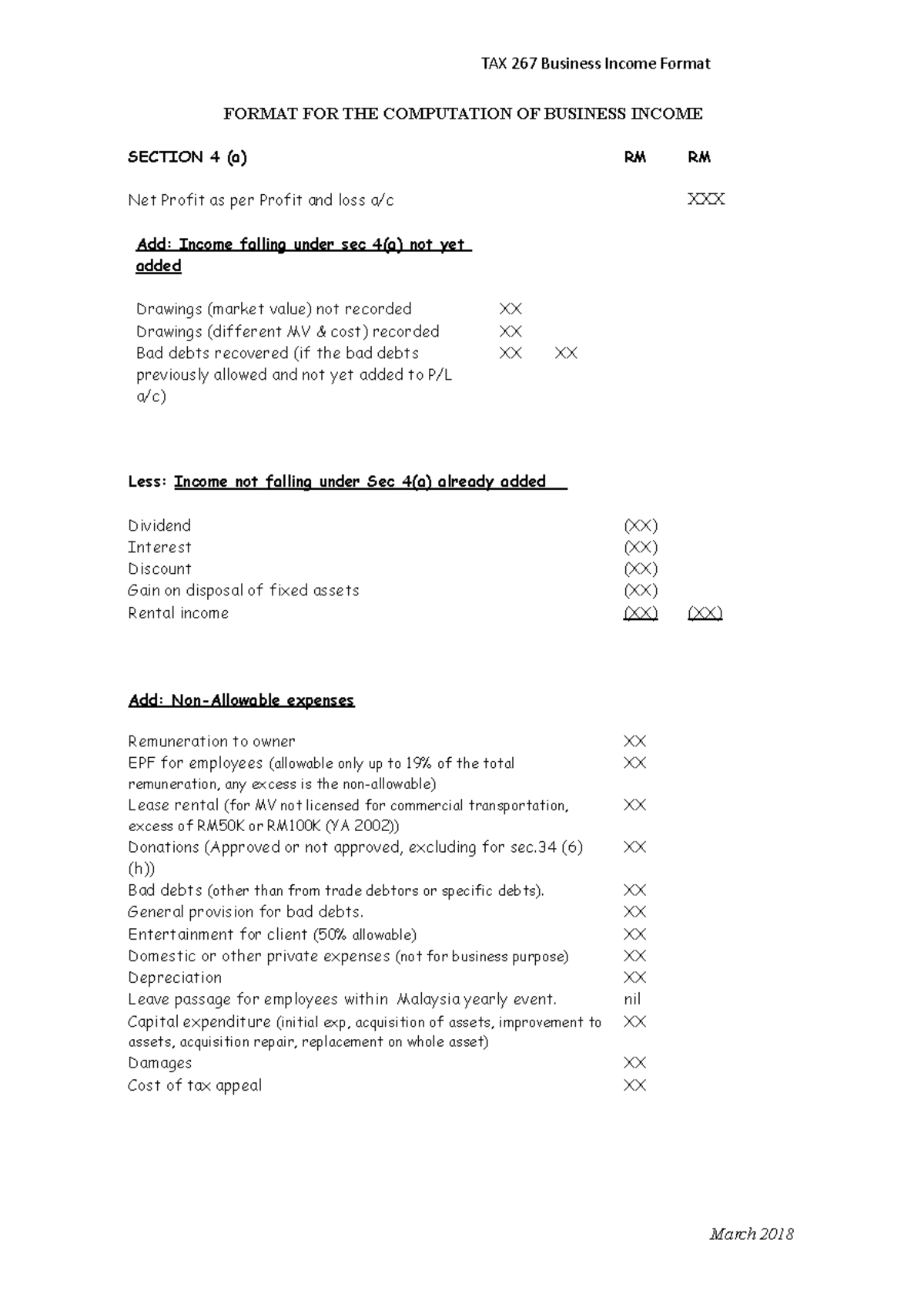

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

0 Comments